Are you looking for the parts of Medicare?

Check out this post as it talks about different types of Medicare (Part A, Part B, Part C and Part D) along with respective Medicare plan coverage.

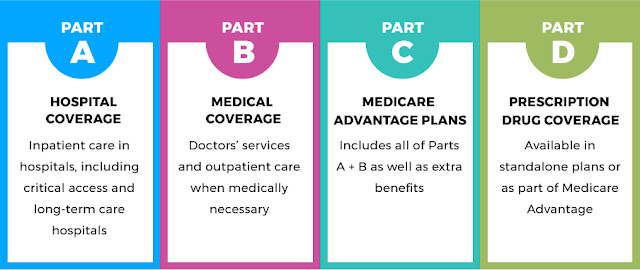

The United States offers Medicare in four different types or parts. They're named sequentially using the alphabet, which makes them Part A, Part B, Part C, and Part D.

Medicare Part C is also referred to as "Medicare Advantage".

Each type provides specific coverage options that provide recipients with a particular benefit. Most Americans qualify for Part A without cost. The other choices have progressive tiers or premiums based on the reported individual or household income.

Medicare Parts Explained

Here is what everyone can expect from each of the four types of Medicare when planning for their healthcare needs for the year.

What Does Medicare Type A Cover?

Medicare Part A is part of the original insurance coverage that the U.S. government manages. This type focuses on hospital stays and skilled nursing care.

- Patients can receive the following services when they qualify for Medicare Type A coverage.

- Inpatient hospital care for illnesses or injuries.

- Skilled nursing facility care for short-term recovery or rehab after experiencing a qualifying hospital stay.

- Nursing home care when a physician deems it to be medically necessary for ongoing health needs.

- Hospice care for end-of-life support.

- Short-term respite care.

- Occupational therapy, physical therapy, and other similar eligible home services.

If an individual or their spouse pays Medicare taxes while working, the premium for Medicare Part A is typically waived. Click and check our post on Medicare Part A to get more details.

What Does Medicare Type B Cover?

Medicare Part B is the other half of the original insurance coverage from the American government. It pays for necessary services that diagnose or treat medical conditions if the services meet an accepted care standard.

Part B services also cover several preventative care needs, such as early-detection screenings and most vaccines.

Individuals who have Medicare Type B coverage can access the following services when they keep their monthly premium current.

- Medical equipment needs, such as wheelchairs, CPAP machines, or blood sugar monitoring devices.

- Ambulance transportation to the hospital when emergency services are necessary.

- Early screening tests for cardiovascular disease and diabetes.

- Common vaccinations and shots, such as shingles and influenza.

- Yearly wellness visits and checkups with a selected doctor.

Even if someone qualifies for Medicare Part A without cost, they must pay the monthly premium for Part B.

The monthly expense is based on household income.

What Does Medicare Type C Cover?

The average premium for Medicare Type C (Medicare Advantage) coverage was only $25 per month in 2020. That fee was in addition to what costs a household would pay for their Part B services.

What Makes Medicare Type C unique is that the plans come from a private health insurance company instead of the federal government.

This structure allows the policy to cover everything that Part A and Part B do while offering additional benefits. Anyone who needs vision, dental, or hearing as part of their comprehensive care plan would want to look at this choice.

It is even possible to receive prescription drug coverage without accessing Part D benefits.

Although Type C plans must follow Medicare guidelines, the expenses and coverage are based on what each person selects. It can be an emergency-only structure or comprehensive care for all potential needs.

This option relies on each person and family to select what they feel is the best healthcare coverage for their current health.

What Does Medicare Type D Cover?

If someone selects Type D coverage from Medicare, they receive prescription medication coverage. This service is not included in Type A or Type B policies. Although this service is optional, it can cut drug-related costs significantly for a small monthly premium.

As with the Type C coverage, each person and household select the prescription drug plan that best fits their needs. The policy cost is dependent on the deductible, content, and coinsurance of the chosen coverage.

Formularies, or the drugs that a Type D plan covers are highly variable. Everyone should review what coverage is available for each one before signing up for a specific policy.

What Medicare Part Type is Right for Me?

Most people select Type A and Type B coverage with their Medicare enrollment. When it gets bundled with Type D for prescription medication, the monthly care costs are reasonable for most households.

With over 60 million beneficiaries expected to receive Medicare in 2021, it is essential to get an enrollment package submitted early to take advantage of these benefits. Some individuals might need to wait for the next open enrollment period before the government accepts their applications.